About Navegg EveryBuyer

There are 13 business industries. We discovered 3 distinct consumption profiles in each one.

-

Focused on consumption

Focused on showing the audience's consumption behavior in 13 industries and the 3 profiles present in each one.

-

Publishers

Offer new segmentation possibilities to advertisers.

-

Combination

Combine Navegg EveryBuyer with other segmentation possibilities to impact the right people, whether to buy or to sell media. Learn more here.

-

Advertisers

This methodology was developed to determine the target, allowing customized ads that will bring better results.

Methodology

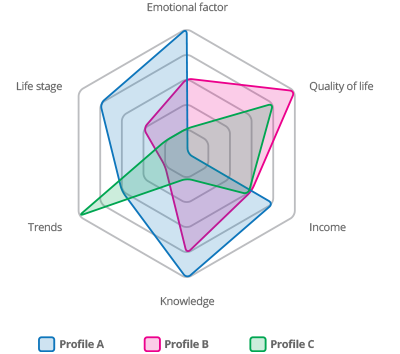

Navegg analyzed purchase intent and interests of internet users and found out the different factors that influence their acquisition behavior in each of the 13 industries.

The combination of segments and its different weights for volume, frequency and recency confirm that people consume in very particular ways in each industry, they tend to relate more to a couple and not so much to others. Based on these studies we came up with Navegg EveryBuyer.

In order to develop the methodology, Navegg identified aspects such as income, emotional factors, quality of life, knowledge about the product or industry, trends and life stage. Finally, we applied a clustering algorithm to identify the main profiles present in each industry.

The 13 industries and their profiles

Understand Navegg EveryBuyer's industries and its consumption profiles.

While on Navegg EveryOne techonology one user can only belong to one cluster, on Navegg EveryBuyer one person can be in different clusters, due to the fact that one customer can have different behaviors towards different industries. For example, being in a certain stage of life, like newlyweds that can have a more aggressive buying behavior in one industry and more soft in others.

-

1 Financial Services

Encompasses all those users who are willing to purchase financial products or services such as Insurance, Investment Plans, Service Packs, Cards, Loans, among others. Examples of advertisers: Banks, Brokerage firm

-

Consumerist

They tend to buy on impulse and rarely return home without without a bag because the purchase act brings them pleasure. They buy things for themselves, family, friends and even for acquaintances. When in debt they seek loans to gain their consumption power back and they love anything that facilitates a purchase.

Participation in Navegg's network:

-

8.42%

Consumerist

-

6.28%

Planner

-

9.40%

Unique Digital

-

8.42%

-

Planner

Organized, controlled and disciplined, this group is always under budget and they know exactly how to prioritize their spending. They prefer to save money instead of spending, so they would rather to invest in private pensions, savings and low risk investments. For them, it is essential to know all the details of a financial transaction and they usually have stable jobs and clear goals for the next stages of life.

Participation in Navegg's network:

-

8.42%

Consumerist

-

6.28%

Planner

-

9.40%

Unique Digital

-

8.42%

-

Unique Digital

Enjoy exclusive and personalized services combined with the convenience that technology offers. They have high consumption power and are bolder over expenditure and investments. Special credit limits and international coverage are essential advantages, while the relationship experience may have a decisive influence on service purchase.

Participation in Navegg's network:

-

8.42%

Consumerist

-

6.28%

Planner

-

9.40%

Unique Digital

-

8.42%

-

-

2 Sports

Represented by people who intend to purchase products or services related to sports. It can either be people who practice sports regularly or those who are just fans. Examples of advertisers: Soccer clubs, Major sports brands, Sporting goods stores

-

Fans

Represented by people who follow a club, league or sports organization and therefore tend to consume all products and services related to that entity. They may be part of an organization that gives them benefits related to games and sporting events. They are passionate and use their emotion on a purchase decision, often surpassing their financial condition.

Participation in Navegg's network:

-

13.79%

Fans

-

7.31%

Health Generation

-

6.17%

Weekend Warriors

-

13.79%

-

Health Generation

People who have a lifestyle totally focused on their physical well-being. They worry about the quality and quantity of food they consume, besides investing time and money on activities and high performance products. Usually attend beauty and esthetics saloon's regularly. Often practice physical activities and are always open to anything that may provide a better health and fitness.

Participation in Navegg's network:

-

13.79%

Fans

-

7.31%

Health Generation

-

6.17%

Weekend Warriors

-

13.79%

-

Weekend Warriors

People who belong to this group live an ordinary life but like to practice some kind of physical activity as a hobby or leisure. Their profile is associated to collectivity as they like to gather their friends for outdoors activities. Their purchase is related to immediate need and therefore are not demanding while choosing, their criteria is either quality or price.

Participation in Navegg's network:

-

13.79%

Fans

-

7.31%

Health Generation

-

6.17%

Weekend Warriors

-

13.79%

-

-

3 Fashion & Beauty

This industry is constituted of people who consume fashion and beauty products or follow its trends. Their prefered items are clothes, shoes, accessories, cosmetics, perfumery and beauty salons services. Examples of advertisers: Cosmetic brands, Cosmetic brands

-

Exclusives

Composed by fashion visionaries, those who follow internacional trends and celebrities. Tend to refinement, innovation and are normally the ones to 'test' and 'aprove' new products in the fashion world. Their purchase is linked to a sense of power and exclusivity, and since they have a high consumption power they end up paying much more just to be ahead.

Participation in Navegg's network:

-

8.10%

Exclusives

-

8.31%

Sophisticated

-

7.87%

Retail

-

8.10%

-

Sophisticated

Represented by people who are always connected to fashion and its trends. They cherish their image above everything and are very sensitive to the sophistication of what they want. They are usually concerned about reputation and luxury of what they choose for themselves and therefore tend to consumerism.

Participation in Navegg's network:

-

8.10%

Exclusives

-

8.31%

Sophisticated

-

7.87%

Retail

-

8.10%

-

Retail

Here are those people who prefer easy credit and discounts have great influence on their decision. They are faithful to the stores they buy from because they become dependent on relationship benefits, such as special cards and credit options. Often seek for basic products and fashion trends do not weight in their decisions.

Participation in Navegg's network:

-

8.10%

Exclusives

-

8.31%

Sophisticated

-

7.87%

Retail

-

8.10%

-

-

4 Vehicles

Formed by users who intend to buy or have affinity with cars, motorcycles, SUVs and other vehicles. They might be looking for their first vehicle or thinking about an upgrade. Examples of advertisers: Automakers, Dealerships

-

Luxury

Represented mostly by upper class men and in this cluster are those who are loyal to brands and can afford luxurious versions of the vehicles they want. Among the key decision factors are comfort and status the car model has. Those who opt for used vehicles typically consider themselves experts or are just fond of old models.

Participation in Navegg's network:

-

8.68%

Luxury

-

7.14%

Compact

-

5.45%

Popular

-

8.68%

-

Compact

Formed mainly by young people and newlyweds. In this group are people who care about the cost-benefit and they like practical cars for daily basis activities and short trips. Design and modernity are significant factors in the decision process.

Participation in Navegg's network:

-

8.68%

Luxury

-

7.14%

Compact

-

5.45%

Popular

-

8.68%

-

Popular

Composed of people who do not have a preference for brands and mainly look for low prices, long-term credit and seasonal offers. These people look for compact models and are also interested in motorcycles and other small vehicles.

Participation in Navegg's network:

-

8.68%

Luxury

-

7.14%

Compact

-

5.45%

Popular

-

8.68%

-

-

5 Homes & Construction

Users who are going through a change and wish to do a renovation or to decorate their home. DIY adopters are also part of this cluster. Examples of advertisers: Furniture and furnishing stores, Building material stores, Architectural firms

-

Handyman

Encompasses people who are always looking for small repairs or renovations to be done, so they tend to often buy small quantities. They normally buy DIY tools, multifunction products and other tools that facilitate their life. They can be trendsetters as they understand about tools' features.

Participation in Navegg's network:

-

7.23%

Handyman

-

5.47%

Luxury & Decoration

-

9.04%

Furnishings

-

7.23%

-

Luxury & Decoration

Sophisticated people who change their home's decoration according to new trends. They are keen to buy more expensive, exclusive and customized products so they seek the guidance of designers and architects. These people like innovation and exclusivity and value art and style more than functionalities.

Participation in Navegg's network:

-

7.23%

Handyman

-

5.47%

Luxury & Decoration

-

9.04%

Furnishings

-

7.23%

-

Furnishings

People who are in a transition period and need to purchase multiple products simultaneously. Credit facility and fast delivery are factors that have influence on their purchase decision. They tend to consume consolidated products and prefer new lines, besides they will probably buy different items for several months in a row.

Participation in Navegg's network:

-

7.23%

Handyman

-

5.47%

Luxury & Decoration

-

9.04%

Furnishings

-

7.23%

-

-

6 Electronics & Appliances

Composed mostly by those who are in a transition phase and need to buy home appliances and electronics, whether because of a personal need, desire for luxury or category upgrade.. Examples of advertisers: Eletronic manufacturers, Home appliance stores

-

Top of the Line

Formed by people who opt for innovation, even if the only difference is a small change in design. Renovation is a constant in their lives and whenever possible they will buy updated models. They usually have high purchase power so they tend to buy high level products and famous brands.

Participation in Navegg's network:

-

4.27%

Top of the Line

-

5.94%

Open House

-

5.36%

Clearance

-

4.27%

-

Open House

These people are in a stage that demands the acquisition of several products simultaneously and therefore opt for combos or cheap products. Since they must purchase many articles at once these people prefer credit facility and seek to buy only the essentials, such as TV, refrigerator and stove.

Participation in Navegg's network:

-

4.27%

Top of the Line

-

5.94%

Open House

-

5.36%

Clearance

-

4.27%

-

Clearance

Tend to be impulsive and are motivated by sales. These people often buy items they don't actually need because they take into account the opportunity. Formed mostly by lower class, they prefer to wait for a product togo on sale even if it is an urgent necessity. The emotional factor has a direct influence on their purchase decision.

Participation in Navegg's network:

-

4.27%

Top of the Line

-

5.94%

Open House

-

5.36%

Clearance

-

4.27%

-

-

7 Real Estate

Users who are currently looking into purchasing or renting a property. Examples of advertisers: Construction companies, Real estate companies

-

Luxury & Family

Composed of people who have a preference for luxury condos or house complex with a club. This group has a good financial condition and prefer apartments and houses with more than three bedrooms. The purchase is usually planned over the years and might follow a life style change or the need for more space.

Participation in Navegg's network:

-

1.31%

Luxury & Family

-

4.33%

Modern Life

-

3.12%

Popular Housing

-

1.31%

-

Modern Life

This audience consists of people with modern careers and who come form financially structured families. They prefer modern buildings, well located and that have facilities such as laundry, gym and gourmet space. They are most likely to choose studio apartments, home/business and small properties.

Participation in Navegg's network:

-

1.31%

Luxury & Family

-

4.33%

Modern Life

-

3.12%

Popular Housing

-

1.31%

-

Popular Housing

Mostly constituted of people who are in charge of the household and tend to buy to meet the needs of the family. They cherish security. These people work hard and have a medium/low consumption power so they would accept to live farther as long as they have more comfort. They are usually looking to own their first property or to rent.

Participation in Navegg's network:

-

1.31%

Luxury & Family

-

4.33%

Modern Life

-

3.12%

Popular Housing

-

1.31%

-

-

8 Food & Beverages

Constituted of users that guide their eating habits according to lifestyle. This cluster includes people seeking a healthy diet or fast food fans. Examples of advertisers: Food and beverage brands, Fast food chains, Restaurants

-

Junk Food

Formed mainly by young or single people who live in big cities and have a hectic routine. They are normally part of low and medium class and look for practical and affordable products. They do not have concerns about health and tend to be shortsighted, putting convenience above well-being.

Participation in Navegg's network:

-

9.81%

Junk Food

-

7.35%

Top Chef

-

4.03%

Healthy

-

9.81%

-

Top Chef

This group consists mainly of housewives and young couples. These people value everything related to appliances and toiletries and cleaning products and they look for the cost-benefit. They have a strong connection to social events, whether with family or friends, so they consume in large quantities.

Participation in Navegg's network:

-

9.81%

Junk Food

-

7.35%

Top Chef

-

4.03%

Healthy

-

9.81%

-

Healthy

Formed mainly by women and men who engage in regular physical activity. They are dedicated to maintaining a good diet and seek professional help, either personal trainer, nutritionist or even reliable information on the internet. Since they understand a lot about the subject they are trendsetters and have purchasing power to maintain the lifestyle.

Participation in Navegg's network:

-

9.81%

Junk Food

-

7.35%

Top Chef

-

4.03%

Healthy

-

9.81%

-

-

9 Travel & Tourism

This industry is comprised of everybody who have an interest in traveling, it can either be a short trip or long vacation. People in this cluster consume plane tickets, hotels, travel packages and tours. Examples of advertisers: Airlines, Hotel chains, Travel agencies

-

Cultural

Most of this audience is composed by teenagers and young adventurers who are still studing and do not have a stabilized career. They often rely on family's sponsorship or take on temporary jobs just to pay for their trips. People interested in culture and education.

Participation in Navegg's network:

-

3.08%

Cultural

-

4.47%

Vacation Packages

-

5.45%

Exclusive Travellers

-

3.08%

-

Vacation Packages

These people value security and practicality mainly because they have no experience planning trips. They look for good prices and the possibility of seeing new places and meeting people without going over their budget. They are well prepared and normally take short breaks during low season, but it's the offer that sets their destiny.

Participation in Navegg's network:

-

3.08%

Cultural

-

4.47%

Vacation Packages

-

5.45%

Exclusive Travellers

-

3.08%

-

Exclusive Travellers

This group is formed by upper and middle class, which are more demanding. Generally single people and couples without children are among this cluster. They generally travel for short periods of time and frequently so they go beyond the traditional tourism offered by websites as they seek culture and differentiated entertainment.

Participation in Navegg's network:

-

3.08%

Cultural

-

4.47%

Vacation Packages

-

5.45%

Exclusive Travellers

-

3.08%

-

-

10 Entertainment

Users who use services and products related to entertainment, they are either motivated by the possibility of having fun or the search for cultural knowledge. Examples of advertisers: Alcohol brands, Concerts and events organizers, Games' developers

-

Cult

Individuals who love culture and art so they frequently go to the movies, museums, galleries and exhibitions. They also like to try exotic restaurants and to buy imported products. As intellectuals they cherish the experience above status and are happy to share their findings and habits.

Participation in Navegg's network:

-

6.24%

Cult

-

5.55%

Party Goers

-

5.69%

Digital

-

6.24%

-

Party Goers

This group consists mainly of young, newly single and single people up to 40 years old. These people like to be in a group, are communicative, enthusiastic and can be represented by social archetypes. Normally value the status of products and services they consume, because they believe it shows who they are.

Participation in Navegg's network:

-

6.24%

Cult

-

5.55%

Party Goers

-

5.69%

Digital

-

6.24%

-

Digital

Crazy about technology, innovations and upgrades, these people invest in digital products and services, such as applications, streaming services (music and movies) and gadgets. They are visionaries, earlyadopters and would exchange traditional services for digital options. The ones who live in major cities they take advantage of trends and in small towns this people will adopt technologies because it is a need.

Participation in Navegg's network:

-

6.24%

Cult

-

5.55%

Party Goers

-

5.69%

Digital

-

6.24%

-

-

11 Career & Education

Built by users who wish to develop their academic or professional careers through technical and language courses, bachelor, graduate and masters' programs. Examples of advertisers: Colleges, Language schools

-

College Entrance Exams

Formed mostly by young people from 16 to 24 years who do not work and rely on financial aid. They consume both virtual and physical content in high volume. They have no purchase restriction as long as the item is something that will help them on their studies. Since they have limited time their overall spending habits are based on practicality and convenience.

Participation in Navegg's network:

-

9.94%

College Entrance Exams

-

8.91%

Career

-

8.15%

Open and Distance Learning

-

9.94%

-

Career

Composed mostly of young, single and financially independent people who are seeking professional development. Most of them wish to work at big companies that require a good academic curriculum. They have a well planned and balanced life, consume innovative products and adventure services.

Participation in Navegg's network:

-

9.94%

College Entrance Exams

-

8.91%

Career

-

8.15%

Open and Distance Learning

-

9.94%

-

Open and Distance Learning

People looking for convenient ways to enhance their knowlege and expertise in specific subjects. Usually because they would like to specialize on something or to change their career path. They are usually single, middle and lower class (class C/D) and don't have kids. They work hard so they see as benefits the possibility to study online and installment payment.

Participation in Navegg's network:

-

9.94%

College Entrance Exams

-

8.91%

Career

-

8.15%

Open and Distance Learning

-

9.94%

-

-

12 Technology

It consists of technology lovers, users who frequently use technology. They either purchase because of personal desire or specific work needs. Examples of advertisers: Techology brands, Technical assistance service, Accessories and peripherals stores

-

Visionaries

Encompasses young people who take risks and seek to be experts in everything that's new. Their financial condition allows them to consume products that are not yet consolidated and therefore quite expensive. Consumption is associated to personal satisfaction and the feeling of being a pioneer.

Participation in Navegg's network:

-

4.78%

Visionaries

-

4.45%

Technophiles

-

4.00%

Professionals

-

4.78%

-

Technophiles

Consumption is strongly linked to status and owning a product is more important than its features. Tend to be emotional and answer well to advertisement appeals and social influence. They are updated and follow products' launches and trends; as compulsive consumers they are susceptible to credit facilities and sales.

Participation in Navegg's network:

-

4.78%

Visionaries

-

4.45%

Technophiles

-

4.00%

Professionals

-

4.78%

-

Professionals

Quality and safety are crucial factors while choosing a product. Their acquisitions are more like investments as they are rational and are hardly swayed by sales. They are faithful to classic brands because of their credibility and use their professional experience on personal purchase decisions.

Participation in Navegg's network:

-

4.78%

Visionaries

-

4.45%

Technophiles

-

4.00%

Professionals

-

4.78%

-

-

13 Tele-communications

Composed by individuals who seek general telecommunication services such as telephone, internet and paid TV; whether analog or digital services. Telephone providers, Cable TV providers

-

New Homes

People who are in a transition phase, new house, newlyweds, career change or social class rise. Product/service credibility and personal referals are factors that influence their choices, besides the need for fast service delivery.

Participation in Navegg's network:

-

4.16%

New Homes

-

5.59%

Comfort

-

5.00%

Prepaid

-

4.16%

-

Comfort

Practical people who choose to pay more if that means more comfort. They are very attached to their family and purchases are intended to benefit everyone, therefore combos are interesting for them. These people also pay for digital services because they recognize the cost-benefit.

Participation in Navegg's network:

-

4.16%

New Homes

-

5.59%

Comfort

-

5.00%

Prepaid

-

4.16%

-

Prepaid

In general, it is strongly represented by the lower class. The acquisition of digital products and services are not among their priorities, because the household budget is tight. The price is the main decision factor so they prefer basic plans and don't mind having less functionalities if the price is lower.

Participation in Navegg's network:

-

4.16%

New Homes

-

5.59%

Comfort

-

5.00%

Prepaid

-

4.16%

-

Solutions

Find out more

248 new segments for building personas

Sportsmen, travelers, gamers and investors are some of the personas that can be developed in greater detail with 248 new segments.

Knowing Navegg’s data

Observed, inferred or behavioral - Navegg’s data help companies of all types and sizes to segment their actions and to get to know their [...]

142 new segments for beverages, football teams, administration, music and cinema.

Navegg has created 142 new segments to meet the demand of its customers.